Week 03 – Firm Boundary

Background information “The Impact of Information Systems on Organizations and Markets”

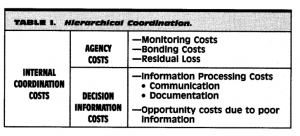

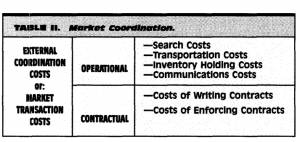

This article examines the impact of information technology on two attributes of firms–firm size and the allocation of decision rights among the various actors in a firm.

The conclusion is 1) a firm may use information systems to decentralize some decision rights and to centralize others, exploiting the merits of both systems and leading to a hybrid structure. 2) when IT plays a significant role in reducing internal coordination costs, a firm may find it advantageous to grow horizontally and vertically. A firm’s use of IT can result in an increase or decrease in either the horizontal or vertical dimension of firm size.

Week 3 Ray et al Yiran

Extant data contradict previous research that the level of vertical integration (VI) has increased rather than decrease with the increasing use of information technology (IT). To address this gap, this paper studies the moderating impact of two measures of competitive environment, demand uncertainty, and industry concentration, on the relationship between IT and VI.

The authors adopt firm level IT spending data from 1995 to 1997 drawn from InformationWeek 500 that had been used in prior research. Matching them with data from other sources, a 2-euation model is used for this paper to address endogenous issue between VI and IT. The results of their analysis show that when demand uncertainty is high or industry concentration is low, IT is associated with a decrease in VI. I. The reason is that IT provides the agility to coordinate with different external partners and specialists. While when in concentrated and in more predictable demand environments, IT may be associated with an increase in VI as firms use IT to coordinate more activities inside the firm to increase revenue, and capture value-add and margin.

This article contribute to the literature by showing the difference in the use of IT across different competitive environments. The implication of this research is that the level of VI may be chosen strategically, given the nature of the competitive environment, which also entails the need for further analysis. Also, since coordination efficiency and effectiveness is possible to affect production costs, future research must explore in greater detail how technology driven coordination and production activities interact, and the implications of this interaction for the level of VI.

Week3_Rawley and Simcoe (2013)_Aaron

Information Technology, Productivity, and Asset Ownership: Evidence from Taxicab Fleets

Since Coase (1937), theories on transaction cost economics and property rights along with a large body of empirical evidence have studied the determinants of the boundary of the firms. Demsetz (1988) propose an alternative predictor, the changes in the productivity of potential trading partners. His thesis has been lacking of empirical support due to informal and imprecise logic. Rawley and Simcoe (2013) thus develop and test a formal productivity-based theory of asset ownership.

Specifically, they examines the effect of productivity-enhancing technology adoption in taxicab industry on vertical integration and skilled workforce. They use microdata on taxicab firms’ vehicle ownership patterns from the economic census during a period from 1992 through 1997 when new computerized dispatching system were first widely adopted.

Their empirical results show that adopting such system cause taxicab firs to increase the percentage of vehicle they own and reduce the returns to skilled labor. This study contributes to two bodies of literature, the strategy literature on firm boundaries and economic literature on skill-biased technical change. First, this paper took the first step to formalize the relationship between productivity and firm boundary and empirically test it. Second, their finding contribute to an emerging view that IT adoption does not always increase the relative demand for more skilled labor.

Week3_Dewan and Ren (2011)_Xinyu Li

Prior literature states that the key to unlock the business value of IT lies in the synergy between IT investment and business strategy. Motivated by this idea, Dewan and Ren (2011) emphasizes the influence of firm boundary on the link between IT investment and firm performance. Their work differs from the previous studies in that they 1) focus on the role of the interaction between IT investment and firm strategy, 2) distinguish firms’ financial performance into return and risk, 3) classify IT investment by the nature of IT investments. The uniqueness affords their work the ability to explain the unsolved “profitability paradox”.

The paper firstly looks at how the boundary of firms moderates the relationship between IT investment and firm performance (return and risk). Two dimensions of the boundary—horizontal integration (diversification) and vertical integration—are discussed respectively. Since one major function of corporate IT is to facilitate coordination, the paper hypothesize that diversification positively moderates the link between IT investment and financial return. Likewise, it negatively moderates the IT-risk link because internal learning tend to reduce uncertainty brought by IT. Related diversification benefits more than unrelated diversification due to less coordination required by unrelated diversification. By the same token, the paper propose that vertical integration will decrease the influence IT investment has on financial risk. However, whether an IT investment is externally oriented should be taken into account when considering the moderating effect of vertical integration on the link between IT investment and financial return. Finally the paper also compares the moderating impact based on other firm characteristics such as service versus manufacturing, high IT-intensity versus low IT-intensity, recent time periods versus older time periods. All of the hypotheses are verified by empirical investigation. Robustness checks are also provided using different measurements of key independent variables and dependent variables.

Week3_Rai et al. (2015)_Vicky Xu

Fit and Misfit of Plural Sourcing Strategies and IT-enabled Process Integration Capabilities: Consequences of Firm Performance in the U.S. Electric Utility Industry

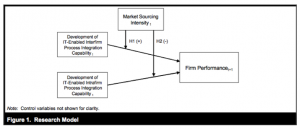

Rai et al. (2015) introduce the concept of market sourcing intensity (MSI), and propose that fit between MSI and the development of IT-enabled interfirm process integration capability improves firm profitability, assessed by return on assets, and misfit between MSI and the development of IT-enabled intrafirm process integration capability extracts penalties in firm profitability.

Rai et al. (2015) address the research question as: How does the (mis) fit between a firm’s plural sourcing strategies and the development of IT-enabled interfirm and intrafirm process integration capabilities influence firm performance? Then Rai et al. (2015) present a theoretical framework as the following (Figure 1., p868):

Where:

- H1: The marginal returns to firm performance from developing IT-enabled interfirm process integration capability increase with an increase in market sourcing intensity.

- H2: The marginal returns to firm performance from developing IT-enabled intrafirm process integration capability decrease with an increase in market sourcing intensity.

Rai et al. (2015) collected a panel dataset using multiple archival sources of firm-year (from 1994 to 2004) that included 6,685 observations for 342 major power-generation utility firms in the United States. After using the OLS estimation method, all the hypothesized relationships were validated.

The significant contributions of this paper include: (1). Elaborating the theoretical explanations on business value created by IT from a capabilities perspective, with a focus on how IT resources and capabilities, to an integrated capabilities-governance perspective, with a focus on the discriminating alignment between capabilities and governance of transactions. (2). Providing suggestions for IT executives and sourcing managers that they can collaborate to create synergies between investments in IT-enabled process integration capabilities and plural sourcing choices.

Week3_Dewan and Ren (2011)_Yaeeun Kim

IT investment as a return or risk. How does a firm increase return and decrease risk by using boundary strategies: vertical integration and diversification.

From the findings, this paper suggests that suitable boundary strategies can moderate the impact of information technology (IT) on firm performance, increasing return and decreasing risk. This tendency is apparent especially when the firm is categorized as service industry, with high levels of IT investment intensity, and in more recent time periods.

Diversification refers to the extent to which the firm chooses to operate in multiple lines of business or product markets, whereas vertical integration is the extent to which value chain activities are conducted inside the firm as opposed to contractually with business partners.

Vertical integration (VIit) is measured with two ways: The first measure is the ratio of value added to sales (Adelman, 1955). Second, an alternate measure was used for robustness, which is less sensitive to industry differences (Fan and Lang, 2000; Ray et al., 2006).

Key dependent variables are firm return and firm risk, and the set of predictor variables includes IT capital, degrees of diversification and vertical integration, along with other firm and industry control variables.

Among key independent variables, a level of diversification (DIVit) was analyzed with the entropy measure (Palepu, 1985).

From the analysis, diversification is negatively associated with both returns and risk at 1% significance level, and vertical integration is positively associated with return but negatively associated with risk model. For the individual interaction term of IT with diversification or IT with vertical integration is positive in return model and negative in risk model, confirming the significant moderating impact of firm boundaries on firm risk-return performance.

Week 3_Rawley and Simcoe (2013)_Jung Kwan Kim

Rawley and Simcoe (2013) examines how technology adoption influences firm boundaries and worker skills. Prior studies have connected the issue of the firm boundaries with asset specificity and contractual incompleteness. More specifically, transaction cost economics (TCE; Williamson, 1975; 1985) suggests that vertical integration helps firms reduce the inevitable cost of conflicts over the division of surplus in a locked-in trading relationship; property right theory (PRT; Grossman and Hart, 1986; Hart and Moore, 1990) emphasizes the incentive of ownership to make efficient but noncontractable investment. In short, TCE and PRT argue that firms are more likely to perform vertical integration with a high asset specificity and a high level of contract incompleteness. Interestingly, Rawley and Simcoe (2013) support the causal relationship between the adoption of a new technology and the increase in vertical integration by holding asset capacity constant.

Based on the in-depth look in the empirical setting of the taxicab industry, the authors find that a technological adoption leads to an increased level of vertical integration and deskilling within the firm, even in the absence of noncontractible changes in asset specificity. On the condition that the marginal benefits of information technology adoption are diminishing with worker ability, this main finding can be intuitively understood in that the technology adoption cannot replace the input capital while the mix of skills and relative productivity of employees can be easily altered.

Week3_Ray et al(2009)_Xue Guo

Competitive Environment and the Relationship Between IT and Vertical Integration

In this paper, authors mainly discussed two questions: 1. How does the competitive environment moderate the relationship between IT and VI (vertical integration)? 2. How does the level of VI in different competitive environments influence firms’ performance (coordination and production cost)? Basically, this paper examines the relationship of four constructs: IT, VI, competitive environment and firm performance.

Previous literature showed that IT is associated with a decrease in VI. However, this paper examines that different competitive environments have various impacts on the relationship between IT and VI. Moreover, the authors found that the level of VI may affect the firms’ performance based on diverse competitive environment.

The paper empirically examines the model using firm-level IT spending data from 1995 to 1997. Two measures of the competitive environment are demand uncertainty and industry concentration that complement each other and the measures of firm performance are coordination cost and production cost. The paper uses 2-equation model, which run both directions (from IT to VI and VI to IT) to examine the first question, which can address the endogeneity problem between IT and VI.

The results suggest that in uncertain demand and in unstable competitive environment, IT is associated with decreased VI. And in more predictable and concentrated environment, IT is associated with increased VI. Also, the paper found that firms made rational strategies about VI and IT in different competitive environments to decrease the coordination and production cost. Compared with the previous literature, this paper provides a more refined understanding of the relationship between IT and VI.

Week3_Ada

Contractibility and Asset Ownership: On-Board Computers and Governance in U.S. Trucking

Key concepts:

On-board computers (OBCs) appeared on the market during the mid-to-late 1980s.There are two classes of OBCs: trip recorders and electronic vehicle management systems (EVMS). Both classes of OBCs provide carriers better measures of how drivers operate trucks.

Incentives for driver ownership of trucks: scope for good driving and scope for rent-seeking[1]

Incentives for carrier ownership of trucks: bargaining power

Research questions:

This paper examines relationships between trucks ownership and the contracting environment, when an important new technology became available that fundamentally changed contractibility in the industry.

Main findings:

Driver ownership of trucks has declined with increases in the contractibility of drivers’ actions. Specifically, 1) driver ownership of trucks decreases with OBC adoption; 2) driver ownership decreases with OBC adoption more for longer than shorter hauls; 3) driver ownership decreases with OBC adoption less for hauls that use trailers for which demands tend to be unidirectional than bidirectional.

Contributions:

Exploration of relationships between OBC adoption and ownership changes constitutes the main empirical contribution of the paper. The analysis in this paper may explain relationships between contractibility and firms’ boundaries in other contexts, especially those in which the care of valuable assets is important. The results in this paper suggest that changes in monitoring technology could change the industry structure in this sector. Such changes could similarly affect the professions.

[1] Rent-seeking is an attempt to obtain economic rent (i.e., the portion of income paid to a factor of production in excess of what is needed to keep it employed in its current use) by manipulating the social or political environment in which economic activities occur, rather than by creating new wealth. Rent-seeking implies extraction of uncompensated value from others without making any contribution to productivity. The classic example of rent-seeking, according to Robert Shiller, is that of a feudal lord who installs a chain across a river that flows through his land and then hires a collector to charge passing boats a fee (or rent of the section of the river for a few minutes) to lower the chain. There is nothing productive about the chain or the collector. The lord has made no improvements to the river and is helping nobody in any way, directly or indirectly, except himself. All he is doing is finding a way to make money from something that used to be free.

Why there are PhD programs in business schools?

Introduction:

Why do business schools offer PhD programs? Unlike science and engineering schools, which usually require a certain amount of labor to conduct experiments and efficiently operate labs, most business schools don’t have labs and thus don’t need students to perform lab work. This is why some top-tier business schools do not have Ph.D. programs. In addition, running a PhD program is expensive. Schools spend a lot of money on PhD students, including tuition, insurance, coursework and support for living expenses.

So what do business schools expect to take away from PhD programs? This’s an important question for PhD students. As a PhD student, you need to understand what the school expects from you and try your best to meet that expectation.

Student 1: I agree that extra labor in business schools is not as much needed as in engineering schools. But I would say we still provide labors to professors, being as a TA or a RA.

Student 2: I think PhD programs could benefit business schools in two ways. First, PhD students help business schools maintain their reputation by presenting at conferences or publishing papers. This benefit could continue even after they graduate. Second, having a PhD program contributes to sustaining the academic community as a whole; if no school offers Ph.D. degrees, there is no next generation of academics.

Student 3: Based on previous discussions, I think investing in a PhD program could be profitable to some extent.

Student 4: In my opinion, it’s not about profit or reputation. It’s about new ideas those students could bring in. Students may not be as productive as professors in terms of doing research. But students with different backgrounds usually have different thoughts. These different thoughts could potentially lead to new ideas and creative research topics. Cooperation between students and professors is beneficial for students as well as for professors and schools.

Student 5: Actually, having a PhD program is a good way to build research networks. Professors will have PhD students, each of whom could have their own students in the future. These mentoring relationships would help business school establish a broad network in academia field.

Comments from the professor:

I agree with most of the opinions. To be clear, we need Ph.D. students, but for a different reason. In my perspective, faculty members do not necessarily need PhD students to do data collection or basic research work. We could hire masters or senior undergraduate students to do such work.

Actually, what is expected from Ph.D. students is fresh idea,s new energy, and enthusiasm, all of which are more important to build a successful research program! New students could bring in new energy, new ideas, and new perspectives. They could lead our attention from academic fields to what’s going on in the outside world. From this view of point, PhD students are not expected to grow as a research assistant or a teaching assistant, but intellectual contributors and independent researchers. This is why we treat Ph.D. students as colleagues.

Another reason could be about the reputation. A good way for a business school to build reputation is to produce good Ph.D. graduates who are placed in top-tier research schools. We understand not all of you would end up in research schools or academic career. But our target is to train you as an independent researcher who can collaborate with faculty members, do your own high-quality research and publish in top journal in the future.

Week 03 – Firm Boundary – paper assignment

| Paper | Student | Background |

| Baker and Hubbard (2004) | Ada | |

| Ray et al. (2009) | Xue | Hitt (1999) |

| Ray et al. (2009) | Yiran | Gurbaxani and Whang (1991) |

| Dewan and Ren (2011) | Xinyu | Dewan et al. (1998) |

| Dewan and Ren (2011) | Yae Eun | Measurement of vertical integration and diversification |

| Rawley and Simcoe (2013) | Aaron | Transaction cost economics, Asset specificity |

| Rawley and Simcoe (2013) | JK | Contract incompleteness, Non-contractibility |

| Rai et al. (2015) | Vicky | will be emailed |