Week 04 – Competition and Partnership

Ceccagnoli 2012—Yiran Week 4

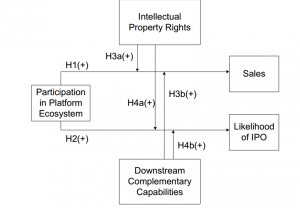

This paper investigated whether participation in an ecosystem partnership will improve the business performance in the context of the enterprise software industry (ISV). The key research questions of this study are (1) Is participation in a platform ecosystem, on average, associated with an increase in performance? (2) How is this improvement in performance affected by an ISV’s ownership of IPRs and specialized downstream capabilities? Two critical performance measures for ISVs were used as DV in this paper: sales and the likelihood of obtaining an initial public offering (IPO). They used a longitudinal data set of 1,210 small ISVs over the period of 1996 – 2004, with information on both ISVs’ decisions to join SAP’s platform ecosystem and information on their business performance. To operatize the participation in platform ecosystem (IV), they also collect partnership formation events through press releases. The stock of software trademarks registered in the United States is used as the measurement of another IV. The research framework is shown in Figure 1

Except for H4b, all the hypotheses are supported, showing that ISVs can achieve significant benefits through participation in a platform ecosystem. Joining a major platform owner’s platform ecosystem is associated with an increase in sales and a greater likelihood of issuing an initial public offering (IPO). Furthermore, these impacts are greater when ISVs have greater intellectual property rights or stronger downstream capabilities. The theoretical contribution lie in implying strong IPRs directly mitigate the negative impact of technology commercialization by ISVs. by affecting the likelihood of platform owner entry. In other words, IPRs appear to favor both value appropriation and value cocreation in the enterprise software industry

Week4_Tafti et al. 2013_Aaron

Extant IS studies have focused on the effects of IT in reducing transaction and coordination costs in inter-organization relationships, there has been little understanding regarding the role of flexible IT architecture as an enabler of interfirm collaboration.

Ali Tafti et al. (2013) fill this academic vacuum by investigating the effects of information technology architecture flexibility on strategic alliance formation and firm value. Specifically, they first examine the effect of three dimensions of IT architecture flexibility (open communication standard, cross-functional transparency, and modularity) on formation of three types of alliances (arm’s-length, collaborative, and joint-venture alliances, respectively.) Second, they study how capability in IT flexibility moderate the value derived from alliances.

To establish the relationship between IT architecture flexibility, strategic alliances and firm value, they utilize a data set from 169 firms that are publicly listed in the US and that span multiple industries. Through panel random-effects models along with several techniques to address potential effects of endogeneity and simultaneity, they found that adoption of open communication standards is associated with the formation of arm’s-length alliances, and modularity of IT architecture is associated with the formation of joint ventures. They also found that the value of alliances is enhanced by overall IT architecture flexibility, implying that all three dimensions of flexibility are important in the value derived from arm’s-length, collaborative and joint-venture alliances.

This study suggests a need for greater consideration of the role of flexibility in IT-driven business process to understand the underpinnings of IT business value in inter-organizational context.

Week4_Tanriverdi & Uysal (2011)_Yaeeun Kim

This paper considered the cross-business information technology integration (CBITI) capability of an acquirer as a potential value-creation mechanism in M&A. This study contributes to the M&A streams within the finance and strategy literature by explaining how and why the CIBTI capability of an acquirer following an acquisition.

In examining the short-run abnormal stock returns, capital markets are indifferent to whether the value will be created out of potential synergies in similar resources of related targets or complementary resources of unrelated targets, but it showed significant result when CBITI capabilities. Event study method was used to measure forward-looking expectations of the capital markets about the value-creation or destruction effects of CBITI in a new M&A. This method assumes that capital markets are efficient (efficient market hypothesis), incorporating into the stock price of the acquirer all relevant information about the acquirer. By setting an event day as 0, the event window is set as five-day [-2, 2], and examining the difference of actual returns and expected returns that when M&A was not announced.

In examining long-run abnormal operating performance (AOP), industry relatedness of a target was significant in moderation effect. Interestingly, the complexity of structure does not deter for superior CBITI capabilities integrate the complementary resources of unrelated targets acquired from different industries. To compute the long-run AOP of an acquirer after a new acquisition, an event study method was used again. This method is designed to capture changes in accounting-based measures of a firm’s operating performance relative to a benchmark, such as M&A. Industry benchmark minimizes problems such as differences in the prevent characteristics of firms leading to operating performance differences before the impact of the M&A event under consideration.

Week4_Tanriverdi and Uysal (2011)_Xinyu

Tanriverdi and Uysal (2011) theoretically develop and empirically validate the idea that the cross-business information technology integration (CBITI) capability of an acquirer is an important value-creation mechanism in mergers and acquisitions.

The paper proposes that CBITI capability create acquirer value through 1) IT cost savings, 2) minimization of potential disruption to business operation, 3) realization of business synergy, and 4) reduction of regulatory costs. Based on prior literature, the CBITI capability is measured by five dimensions of the IT integration of acquirer and target firms, and the data is collected from a survey published in Tanriverdi (2006). The value created in mergers and acquisitions is divided into short-run market-based value and long-run accounting-based value, which are observed through event study methods on capital market and firms’ operating performance, respectively. The value creation is proposed to be moderated by the industry relatedness between acquirer and target firms, which is also measured by the survey.

The findings indicate that, in the short run, acquirers with high levels of CBITI capability receive positive and significant abnormal returns on the capital markets. In the long run, acquirers with high levels of CBITI capability obtain significantly higher abnormal operating performance. However, the moderating effect of industry relatedness is only found in the long run scenario.

It is the first paper that link the construct of CBITI with mergers and acquisition performance.

Week 4_Chellappa et al. (2010)_Jung Kwan Kim

The research of Chellappa, Sambamurthy, and Saraf (2010) is motivated by conflicting arguments in strategy literature to respond the question: is it beneficial to participate in a crowded market or not? By examining the enterprise systems software (ESS) industry, the authors argue that the detrimental effect of being in a crowded market can be counteracted by the virtuous effect of demand externality.

More specifically, the authors suggest that “the performance of an ESS firm is positively related to its degree of multimarket contact with the other ESS firms” (Hypothesis 1). This is mainly because ESS firms in a market may enjoy the mutual forbearance to secure higher market performance if they are more familiar with and more fearful to each other based on the possibility of retaliation. The Hypothesis 2 is also supported, though weakly, saying that “the performance of an ESS firm is positively related to its degree of participation in crowded markets, or the extent of market domain overlap.” The customers perceive the presence of many ESS firms in a market as a positive signal about the importance and the legitimacy of the component in the market. Also, the crowded market attracts more knowledge brokers (such as consultants), reinforcing the legitimacy and the viability. Thus, the participation in a crowded market may bring a positive performance, though the outcome can be somewhat mitigated by the intensity of competition. Finally, the Hypothesis 3 contends that “the positive effects of ESS firms’ participation in crowded markets are increased by the level of multimarket contact with other ESS firms.” This hypothesis is also supported in that an ESS firm in a crowded market with high multimarket contact understands rivals better and in that such ESS firm has more ways to retaliate any rivalrous activities of other similar firms.

In conclusion, ESS firms may benefit from competing in many crowded markets, a counterintuitive implication to traditional strategy scholars.

Week4_Chellappa et al (2010)_Xue Guo

Competing in Crowded Markets: Multimarket contact and the Nature of Competition in the Enterprise Systems software industry

This paper examines the performance consequences of competition among enterprise systems software (ESS) providers. The authors provide reasons for the appearance of ESS firms in the crowded markets and shed light on ESS firms’ strategies in competitive markets.

The paper mainly discussed the effects of multimarket contact and participation in crowded market on ESS firms’ performance. Based on the previous literature about the mutual forbearance and crowded market structure, the authors proposes that multimarket contact can foster mutual forbearance, which is positively related to firm performance, and the participation in crowded market also positively associated with firm performance by demand externalities.

The authors empirically test the hypothesis by a merging dataset across three time periods. It builds a random effect model, which contains the dependent variable—firms’ performance and the main independent variables—multimarket contact, participation and the interaction term of these two. Also, the authors incorporate a temporal lag between Dependent Variable and the other variables to avoid causal ambiguity. The results showed that the coefficient of multimarket contact and the interaction term is positive and significant. The coefficient of participation is weakly significant. These results suggest that firms do not benefit by offering a large number of software components. However, firms stand to benefit if they strategically choose specific market. In addition, firms gain performance benefits by competing in the crowded market but it may be diluted by increased market overlap and competitive rivalry.

This paper contributes to the literature by further examining performance consequences in crowded market of ESS firms and studying the joint effects of multimarket contact and market overlap on ESS firm performance. At the same time, it provides meaningful implications for firm strategy and management.

Week4_Chi et al. (2010)_Vicky Xu

Information Technology, Network Structure, and Competitive Action

Over the last 20 years, firms have increasingly used IT to create and manage their interfirm networks. And prior studies tried to explore the relationships among the structural properties of interorganizational networks IT use, and competitive behavior. However, more researches on the complex interplay between different types of network structure and IT and their effects on competitive behavior of firms are needed. Chi et al. (2010) focus on the sparse-versus-dense network structure of interorganizational networks and aim to examine how two different types (Sparse and dense) of network structure interact with IT to influence firm competitive action which has examined three recognizable patterns as: action volume, action complexity, and action heterogeneity.

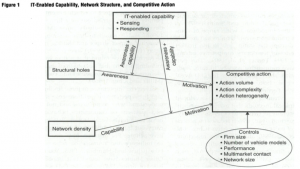

Chi et al. (2010) present the theoretical model as following (Figure 1, p546):

Chi et al. (2010) collected a sample of firms from the global automobile industry (SIC 3711) that sell autos in the U.S. market to test the hypotheses in the study. The firm-level panel data from 1988 to 2003 includes: competitive action data, alliance network data, and IT-enabled capability data. The random-effects model was performed to analyze the data.

Chi et al. (2010) find that network structure rich in structural holes has a positive direct effect on firms’ ability to introduce a greater number and a wider range of competitive actions. And firms benefit from dense network structure only when they develop a strong IT-enabled capability. In addition, firms can use IT to complement both types of network structure to increase all three behavioral drivers for competitive actions.

The contributions are: 1). Presenting an attempt to systematically explore the significant interplay between interfirm network and IT. 2). Contributing to research on IT valuation by demonstrating the moderating role of IT-enabled capability on the effects of network structure on firm action. 3). Advancing competitive dynamics research by showing how sparse-verse-dense network structure differentially affects competitive behavior of firms. 4). Extending the awareness-motivation-capability (AMC) framework by focusing on attributes and patterns of competitive action repertoire. 5). Important practical implications which suggest that managers need to consider the network structure in which their firms are embedded when designing their technology infrastructure.

Information Technology, Network Structure, and Competitive Action—Ada

Information Technology, Network Structure, and Competitive Action

Motivation:

Recent research suggests that the structure of alliance networks is an important determinant of firms’ potential to access valuable knowledge and resources which, in turn, enable them to outcompete rivals. But the conclusions are competing. Some researchers emphasize the advantages of dense network structure in which all partners of a focal firm closely collaborate with one another. Alternatively, other researchers argue that a sparse network structure rich in structural holes is beneficial to the firms.

Research Question:

We examine how these two contrasting types (dense and sparse) of network structure affect competitive behavior of firms and what is the role of IT as an important moderator of the relationship between each type of network structure and competitive firm behavior.

Data and Method:

- Firm-level panel data;

- Random effect;

Main Findings:

- Firms can benefit from both types of network structure. First, structure holes have a positive direct effect on automakers’ ability to compete aggressively by undertaking a greater volume and a broader range of competitive actions. Second, we have also found a positive effect of network density on action volume and action complexity when automakers have a high level of IT-enabled capability.

- IT-enabled capability has a distinctive effect on each type of network structure which, in turn, has significant implications on firms’ competitive behavior. In particular, IT-enabled capability plays two roles: complementary and substitutive. On one hand, we have found that IT-enabled capability enhances (complements) the effects of network density on competitive actions. On the other hand, IT-enabled capability compensates for (or substitutes) the effects of structural holes on competitive action.

Background Reading: (Shaping Agility Through Digital Options: Reconceptualizing The Role Of Information Technology In Contemporary Firms)

By drawing upon recent thinking in the strategy entrepreneurship and IT management literatures, this paper clarified how information technology investments and capabilities influence firm performance by shaping three significant organizational capabilities (agility, digital options and entrepreneurial alertness) and strategic processes (capability building entrepreneurial action and co-evolutionary adaptation).

Week 04 – Competition and Partnership – paper assignment

| Paper | Student | Background |

| Chi et al. (2010) | Vicky | Network structure (structural holes, network density) |

| Chi et al. (2010) | Ada | Sambamurthy, Bharadwaj, and Grover (2003) |

| Chellappa et al. (2010) | Xue | Two-sided markets |

| Chellappa et al. (2010) | JK | Baum and Korn (1996) – measurement of multimarket contact and crowded market |

| Tanriverdi and Uysal (2011) | Yae Eun | Efficient market hypothesis, Event study methodology |

| Tanriverdi and Uysal (2011) | Xinyu | Tanriverdi (2006) |

| Ceccagnoli et al. (2012) | Yiran | Difference in patent, copyright, and trademark |

| Tafti et al. (2013) | Aaron | Modularity of IT architecture, Service-oriented architecture |