Weekly Briefs

Week5_Subramanyam et al (2012)_Xue Guo

In Search of Efficient Flexibility: Effects of Software Component Granularity on Development Effort, Defects, and Customization Effort

This paper mainly examines the relationship between software component design dimensions and software development outcomes in the context of model-driven, component-based software development (MDCD). It explores how different software design dimensions affect the trade-off between efficiency and flexibility.

The authors proposed that component granularity design (fine-grained & coarse-grained) decision plays an important role in the relationship between realized development efficiency and flexibility, i.e. the coarse-grained component would be associated with greater flexibility but less efficiency. The paper also proposes that mediating effect of in-process defects between component granularity and the development and customization efforts.

This paper empirically tests the effects of component granularity on development efficiency and flexibility from a sample of 92 data. The empirical models contain three dependent variables: in-process defects, development effort and customization effort. And the main independent variables include three measures of the component granularity: data elements, data layer interfaces and internal interfaces. The paper uses three-stage least squares regressions (3SLS) to address the simultaneity among certain measures and seemingly unrelated regression (SUR) to examine consistency of results. And it tests the hypothesis by conducting join tests for three measures of the component granularity. The empirical results support all of the author previous hypothesis.

The contribution of this paper is that it provides three measures of component granularity which match with the generic structural complexity dimensions and empirically establish the importance of component granularity design decision on the trade-offs between efficiently and flexibility.

Week5_Subramanyam et al. (2012)_Aaron

In Search of Efficient Flexibility: Effects of Software Component Granularity on Development Effort, Defects and Customization Effort

The trade-off between efficiency and flexibility in enterprise software production poses a big challenge for firms. New software development paradigms emphasize modular design of complex systems to overcome such challenge. However, there remains little understanding on the use of such software methodologies and associated extent to such trade-offs that can be influenced.

Subramanyam et al. (2012) addressed this gap by investigating the performance outcomes of a model-driven, component-based software development methodology. Specifically, they discuss how a design characteristics of software components, component granularity (with sub-dimensions of code volume, functionality and independence), affects development efficiency (development effort and in-process defects) and flexibility (customization effort).

To test such effects, they utilized a cross-sectional dataset that covers the software development information about 92 business software components of a firm’s enterprise resource planning product. Through 3SLS and SUR analysis, they found that coarse grained components are associated with higher flexibility but are associated with lower development efficiency. Moreover, they found that defects partially mediate the relationship between component granularity and flexibility.

The key implication from this study for software managers and designers who seeks to adopt modular design approaches is that active and judicious management of component granularity resulting from the decomposition of complex enterprise systems is necessary to simultaneously achieve flexibility and efficiency in software development.

Week5_Grewal et al.(2006)_Yaeeun Kim

This article examined the effects of network embeddedness on the success of open source projects. The authors assume heterogeneity and investigated how these structure differ across project and managers. They showed that there is significant effect of network embeddedness on technical and commercial success. By using latent class regression analysis, they showed that different aspects of network embeddedness have powerful but subtle effects on project success. In this case, the valence of word-of-mouth (WOM) decides the success (the number of page view or downloads).

According to the social contagion, positive WOM within the network of users would result in more users visiting the project websites (externality), and leads to commercial success. However, they assume that negative WOM would make a decrease in outcome (or the number of downloads).

The result shows that project network embeddedness positively influences project technical success, while the effect of project manager network embeddedness is more complex and different for older projects when compared with younger project. They used centrality for method: degree centrality is the number of projects in which the manager participates (structural embeddedness), betweenness centrality is the number of paths between other nodes on which the manager lies (junctional embeddedness), and eigenvector centrality is the manager participates in important projects (positional embeddedness).

In summary, the article shows that the effect of project network embeddedness positively influenced project technical success. However, the effect of project manager network embeddedness varies in the year of project. As a result, the network embeddedness was more influential to technical success, which were attractive to developers visually, but the influence was less powerful in commercial success, which were less visible to users.

Week 5 Ada—Ramasubbu and Kemerer (2015)

Technical Debt and the Reliability of Enterprise Software Systems:

A Competing Risks Analysis

Key Concept:

Technical Debt: Taking design shortcuts and other maintenance activities software organizations incur what has been referred to as technical debt, that is, accumulated maintenance obligations that must be addressed in the future

Motivation:

Technical debt reduction in an enterprise software systems environment is difficult, and maintenance of such systems is especially challenging because of the interdependencies and potential for conflict between the underlying, vendor-supplied platform and the customization done by individual clients. These interdependencies make it difficult to measure and assess the impact of technical debt on system reliability and therefore to plan the software maintenance activities necessary to reduce the debt.

Research Question:

- Model and empirically analyze the impact of technical debt on system reliability.

- Examine the relative effects of modular and architectural maintenance activities undertaken by clients in order to analyze the dynamics of technical debt reduction.

Main Findings:

- Technical debt decreases the reliability of enterprise systems.

- Modular maintenance targeted to reduce technical debt was about 53% more effective than architectural maintenance in reducing the probability of a system failure due to client errors.

- Modular maintenance had the side-effect of increasing the chance of a system failure due to vendor errors by about 83% more than did architectural maintenance activities.

Contributions:

- This study empirically measure the technical debt accumulated in real world enterprise software and to assess its dynamic impact on system reliability.

- They address this challenge by utilizing a competing risks analysis approach that account for event-specific hazards that impact the failure of enterprise software systems.

- They utilize the empirical results to illustrate how firms could evaluate their business risks exposure due to technical debt accumulation in their enterprise systems and assess the likely effects, both positive and negative, of a range of software maintenance practices.

Competing risks:

Competing-risks survival regression provides a useful alternative to Cox regression in the presence of one or more competing risks. For example, say that you are studying the time from initial treatment for cancer to recurrence of cancer in relation to the type of treatment administered and demographic factors. Death is a competing event: the person under treatment may die, impeding the occurrence of the event of interest, recurrence of cancer. Unlike censoring, which merely obstructs you from viewing the event, a competing event prevents the event of interest from occurring altogether, and your analysis should adjust accordingly. As a technical consequence, an individual observed to fail from a competing risk is assumed to still be at risk between its real-life failure time and its potential future censoring time.

This fact has two important implications. First, the naïve Kaplan–Meier that takes the competing events as censored observations, is biased. Secondly, the way in which covariates are associated with the cause-specific hazards may not coincide with the way these covariates are associated with the cumulative incidence.

A complete understanding of the event dynamics requires that both cause-specific and sub-distribution hazards to be analyzed. The difference between cause-specific and sub-distribution hazards is the risk set. For the cause-specific hazard the risk set decreases each time there is a death from another cause censoring. With the sub-distribution hazard subjects that die from another cause remain in the risk set and are given a censoring time that is larger than all event times.

Ceccagnoli 2012—Yiran Week 4

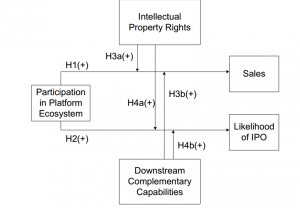

This paper investigated whether participation in an ecosystem partnership will improve the business performance in the context of the enterprise software industry (ISV). The key research questions of this study are (1) Is participation in a platform ecosystem, on average, associated with an increase in performance? (2) How is this improvement in performance affected by an ISV’s ownership of IPRs and specialized downstream capabilities? Two critical performance measures for ISVs were used as DV in this paper: sales and the likelihood of obtaining an initial public offering (IPO). They used a longitudinal data set of 1,210 small ISVs over the period of 1996 – 2004, with information on both ISVs’ decisions to join SAP’s platform ecosystem and information on their business performance. To operatize the participation in platform ecosystem (IV), they also collect partnership formation events through press releases. The stock of software trademarks registered in the United States is used as the measurement of another IV. The research framework is shown in Figure 1

Except for H4b, all the hypotheses are supported, showing that ISVs can achieve significant benefits through participation in a platform ecosystem. Joining a major platform owner’s platform ecosystem is associated with an increase in sales and a greater likelihood of issuing an initial public offering (IPO). Furthermore, these impacts are greater when ISVs have greater intellectual property rights or stronger downstream capabilities. The theoretical contribution lie in implying strong IPRs directly mitigate the negative impact of technology commercialization by ISVs. by affecting the likelihood of platform owner entry. In other words, IPRs appear to favor both value appropriation and value cocreation in the enterprise software industry

Week4_Tafti et al. 2013_Aaron

Extant IS studies have focused on the effects of IT in reducing transaction and coordination costs in inter-organization relationships, there has been little understanding regarding the role of flexible IT architecture as an enabler of interfirm collaboration.

Ali Tafti et al. (2013) fill this academic vacuum by investigating the effects of information technology architecture flexibility on strategic alliance formation and firm value. Specifically, they first examine the effect of three dimensions of IT architecture flexibility (open communication standard, cross-functional transparency, and modularity) on formation of three types of alliances (arm’s-length, collaborative, and joint-venture alliances, respectively.) Second, they study how capability in IT flexibility moderate the value derived from alliances.

To establish the relationship between IT architecture flexibility, strategic alliances and firm value, they utilize a data set from 169 firms that are publicly listed in the US and that span multiple industries. Through panel random-effects models along with several techniques to address potential effects of endogeneity and simultaneity, they found that adoption of open communication standards is associated with the formation of arm’s-length alliances, and modularity of IT architecture is associated with the formation of joint ventures. They also found that the value of alliances is enhanced by overall IT architecture flexibility, implying that all three dimensions of flexibility are important in the value derived from arm’s-length, collaborative and joint-venture alliances.

This study suggests a need for greater consideration of the role of flexibility in IT-driven business process to understand the underpinnings of IT business value in inter-organizational context.

Week4_Tanriverdi & Uysal (2011)_Yaeeun Kim

This paper considered the cross-business information technology integration (CBITI) capability of an acquirer as a potential value-creation mechanism in M&A. This study contributes to the M&A streams within the finance and strategy literature by explaining how and why the CIBTI capability of an acquirer following an acquisition.

In examining the short-run abnormal stock returns, capital markets are indifferent to whether the value will be created out of potential synergies in similar resources of related targets or complementary resources of unrelated targets, but it showed significant result when CBITI capabilities. Event study method was used to measure forward-looking expectations of the capital markets about the value-creation or destruction effects of CBITI in a new M&A. This method assumes that capital markets are efficient (efficient market hypothesis), incorporating into the stock price of the acquirer all relevant information about the acquirer. By setting an event day as 0, the event window is set as five-day [-2, 2], and examining the difference of actual returns and expected returns that when M&A was not announced.

In examining long-run abnormal operating performance (AOP), industry relatedness of a target was significant in moderation effect. Interestingly, the complexity of structure does not deter for superior CBITI capabilities integrate the complementary resources of unrelated targets acquired from different industries. To compute the long-run AOP of an acquirer after a new acquisition, an event study method was used again. This method is designed to capture changes in accounting-based measures of a firm’s operating performance relative to a benchmark, such as M&A. Industry benchmark minimizes problems such as differences in the prevent characteristics of firms leading to operating performance differences before the impact of the M&A event under consideration.

Week4_Tanriverdi and Uysal (2011)_Xinyu

Tanriverdi and Uysal (2011) theoretically develop and empirically validate the idea that the cross-business information technology integration (CBITI) capability of an acquirer is an important value-creation mechanism in mergers and acquisitions.

The paper proposes that CBITI capability create acquirer value through 1) IT cost savings, 2) minimization of potential disruption to business operation, 3) realization of business synergy, and 4) reduction of regulatory costs. Based on prior literature, the CBITI capability is measured by five dimensions of the IT integration of acquirer and target firms, and the data is collected from a survey published in Tanriverdi (2006). The value created in mergers and acquisitions is divided into short-run market-based value and long-run accounting-based value, which are observed through event study methods on capital market and firms’ operating performance, respectively. The value creation is proposed to be moderated by the industry relatedness between acquirer and target firms, which is also measured by the survey.

The findings indicate that, in the short run, acquirers with high levels of CBITI capability receive positive and significant abnormal returns on the capital markets. In the long run, acquirers with high levels of CBITI capability obtain significantly higher abnormal operating performance. However, the moderating effect of industry relatedness is only found in the long run scenario.

It is the first paper that link the construct of CBITI with mergers and acquisition performance.

Week 4_Chellappa et al. (2010)_Jung Kwan Kim

The research of Chellappa, Sambamurthy, and Saraf (2010) is motivated by conflicting arguments in strategy literature to respond the question: is it beneficial to participate in a crowded market or not? By examining the enterprise systems software (ESS) industry, the authors argue that the detrimental effect of being in a crowded market can be counteracted by the virtuous effect of demand externality.

More specifically, the authors suggest that “the performance of an ESS firm is positively related to its degree of multimarket contact with the other ESS firms” (Hypothesis 1). This is mainly because ESS firms in a market may enjoy the mutual forbearance to secure higher market performance if they are more familiar with and more fearful to each other based on the possibility of retaliation. The Hypothesis 2 is also supported, though weakly, saying that “the performance of an ESS firm is positively related to its degree of participation in crowded markets, or the extent of market domain overlap.” The customers perceive the presence of many ESS firms in a market as a positive signal about the importance and the legitimacy of the component in the market. Also, the crowded market attracts more knowledge brokers (such as consultants), reinforcing the legitimacy and the viability. Thus, the participation in a crowded market may bring a positive performance, though the outcome can be somewhat mitigated by the intensity of competition. Finally, the Hypothesis 3 contends that “the positive effects of ESS firms’ participation in crowded markets are increased by the level of multimarket contact with other ESS firms.” This hypothesis is also supported in that an ESS firm in a crowded market with high multimarket contact understands rivals better and in that such ESS firm has more ways to retaliate any rivalrous activities of other similar firms.

In conclusion, ESS firms may benefit from competing in many crowded markets, a counterintuitive implication to traditional strategy scholars.

Week4_Chellappa et al (2010)_Xue Guo

Competing in Crowded Markets: Multimarket contact and the Nature of Competition in the Enterprise Systems software industry

This paper examines the performance consequences of competition among enterprise systems software (ESS) providers. The authors provide reasons for the appearance of ESS firms in the crowded markets and shed light on ESS firms’ strategies in competitive markets.

The paper mainly discussed the effects of multimarket contact and participation in crowded market on ESS firms’ performance. Based on the previous literature about the mutual forbearance and crowded market structure, the authors proposes that multimarket contact can foster mutual forbearance, which is positively related to firm performance, and the participation in crowded market also positively associated with firm performance by demand externalities.

The authors empirically test the hypothesis by a merging dataset across three time periods. It builds a random effect model, which contains the dependent variable—firms’ performance and the main independent variables—multimarket contact, participation and the interaction term of these two. Also, the authors incorporate a temporal lag between Dependent Variable and the other variables to avoid causal ambiguity. The results showed that the coefficient of multimarket contact and the interaction term is positive and significant. The coefficient of participation is weakly significant. These results suggest that firms do not benefit by offering a large number of software components. However, firms stand to benefit if they strategically choose specific market. In addition, firms gain performance benefits by competing in the crowded market but it may be diluted by increased market overlap and competitive rivalry.

This paper contributes to the literature by further examining performance consequences in crowded market of ESS firms and studying the joint effects of multimarket contact and market overlap on ESS firm performance. At the same time, it provides meaningful implications for firm strategy and management.

Week4_Chi et al. (2010)_Vicky Xu

Information Technology, Network Structure, and Competitive Action

Over the last 20 years, firms have increasingly used IT to create and manage their interfirm networks. And prior studies tried to explore the relationships among the structural properties of interorganizational networks IT use, and competitive behavior. However, more researches on the complex interplay between different types of network structure and IT and their effects on competitive behavior of firms are needed. Chi et al. (2010) focus on the sparse-versus-dense network structure of interorganizational networks and aim to examine how two different types (Sparse and dense) of network structure interact with IT to influence firm competitive action which has examined three recognizable patterns as: action volume, action complexity, and action heterogeneity.

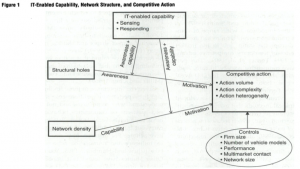

Chi et al. (2010) present the theoretical model as following (Figure 1, p546):

Chi et al. (2010) collected a sample of firms from the global automobile industry (SIC 3711) that sell autos in the U.S. market to test the hypotheses in the study. The firm-level panel data from 1988 to 2003 includes: competitive action data, alliance network data, and IT-enabled capability data. The random-effects model was performed to analyze the data.

Chi et al. (2010) find that network structure rich in structural holes has a positive direct effect on firms’ ability to introduce a greater number and a wider range of competitive actions. And firms benefit from dense network structure only when they develop a strong IT-enabled capability. In addition, firms can use IT to complement both types of network structure to increase all three behavioral drivers for competitive actions.

The contributions are: 1). Presenting an attempt to systematically explore the significant interplay between interfirm network and IT. 2). Contributing to research on IT valuation by demonstrating the moderating role of IT-enabled capability on the effects of network structure on firm action. 3). Advancing competitive dynamics research by showing how sparse-verse-dense network structure differentially affects competitive behavior of firms. 4). Extending the awareness-motivation-capability (AMC) framework by focusing on attributes and patterns of competitive action repertoire. 5). Important practical implications which suggest that managers need to consider the network structure in which their firms are embedded when designing their technology infrastructure.

Information Technology, Network Structure, and Competitive Action—Ada

Information Technology, Network Structure, and Competitive Action

Motivation:

Recent research suggests that the structure of alliance networks is an important determinant of firms’ potential to access valuable knowledge and resources which, in turn, enable them to outcompete rivals. But the conclusions are competing. Some researchers emphasize the advantages of dense network structure in which all partners of a focal firm closely collaborate with one another. Alternatively, other researchers argue that a sparse network structure rich in structural holes is beneficial to the firms.

Research Question:

We examine how these two contrasting types (dense and sparse) of network structure affect competitive behavior of firms and what is the role of IT as an important moderator of the relationship between each type of network structure and competitive firm behavior.

Data and Method:

- Firm-level panel data;

- Random effect;

Main Findings:

- Firms can benefit from both types of network structure. First, structure holes have a positive direct effect on automakers’ ability to compete aggressively by undertaking a greater volume and a broader range of competitive actions. Second, we have also found a positive effect of network density on action volume and action complexity when automakers have a high level of IT-enabled capability.

- IT-enabled capability has a distinctive effect on each type of network structure which, in turn, has significant implications on firms’ competitive behavior. In particular, IT-enabled capability plays two roles: complementary and substitutive. On one hand, we have found that IT-enabled capability enhances (complements) the effects of network density on competitive actions. On the other hand, IT-enabled capability compensates for (or substitutes) the effects of structural holes on competitive action.

Background Reading: (Shaping Agility Through Digital Options: Reconceptualizing The Role Of Information Technology In Contemporary Firms)

By drawing upon recent thinking in the strategy entrepreneurship and IT management literatures, this paper clarified how information technology investments and capabilities influence firm performance by shaping three significant organizational capabilities (agility, digital options and entrepreneurial alertness) and strategic processes (capability building entrepreneurial action and co-evolutionary adaptation).

Week 3 Ray et al Yiran

Extant data contradict previous research that the level of vertical integration (VI) has increased rather than decrease with the increasing use of information technology (IT). To address this gap, this paper studies the moderating impact of two measures of competitive environment, demand uncertainty, and industry concentration, on the relationship between IT and VI.

The authors adopt firm level IT spending data from 1995 to 1997 drawn from InformationWeek 500 that had been used in prior research. Matching them with data from other sources, a 2-euation model is used for this paper to address endogenous issue between VI and IT. The results of their analysis show that when demand uncertainty is high or industry concentration is low, IT is associated with a decrease in VI. I. The reason is that IT provides the agility to coordinate with different external partners and specialists. While when in concentrated and in more predictable demand environments, IT may be associated with an increase in VI as firms use IT to coordinate more activities inside the firm to increase revenue, and capture value-add and margin.

This article contribute to the literature by showing the difference in the use of IT across different competitive environments. The implication of this research is that the level of VI may be chosen strategically, given the nature of the competitive environment, which also entails the need for further analysis. Also, since coordination efficiency and effectiveness is possible to affect production costs, future research must explore in greater detail how technology driven coordination and production activities interact, and the implications of this interaction for the level of VI.

Week3_Rawley and Simcoe (2013)_Aaron

Information Technology, Productivity, and Asset Ownership: Evidence from Taxicab Fleets

Since Coase (1937), theories on transaction cost economics and property rights along with a large body of empirical evidence have studied the determinants of the boundary of the firms. Demsetz (1988) propose an alternative predictor, the changes in the productivity of potential trading partners. His thesis has been lacking of empirical support due to informal and imprecise logic. Rawley and Simcoe (2013) thus develop and test a formal productivity-based theory of asset ownership.

Specifically, they examines the effect of productivity-enhancing technology adoption in taxicab industry on vertical integration and skilled workforce. They use microdata on taxicab firms’ vehicle ownership patterns from the economic census during a period from 1992 through 1997 when new computerized dispatching system were first widely adopted.

Their empirical results show that adopting such system cause taxicab firs to increase the percentage of vehicle they own and reduce the returns to skilled labor. This study contributes to two bodies of literature, the strategy literature on firm boundaries and economic literature on skill-biased technical change. First, this paper took the first step to formalize the relationship between productivity and firm boundary and empirically test it. Second, their finding contribute to an emerging view that IT adoption does not always increase the relative demand for more skilled labor.

Week3_Dewan and Ren (2011)_Xinyu Li

Prior literature states that the key to unlock the business value of IT lies in the synergy between IT investment and business strategy. Motivated by this idea, Dewan and Ren (2011) emphasizes the influence of firm boundary on the link between IT investment and firm performance. Their work differs from the previous studies in that they 1) focus on the role of the interaction between IT investment and firm strategy, 2) distinguish firms’ financial performance into return and risk, 3) classify IT investment by the nature of IT investments. The uniqueness affords their work the ability to explain the unsolved “profitability paradox”.

The paper firstly looks at how the boundary of firms moderates the relationship between IT investment and firm performance (return and risk). Two dimensions of the boundary—horizontal integration (diversification) and vertical integration—are discussed respectively. Since one major function of corporate IT is to facilitate coordination, the paper hypothesize that diversification positively moderates the link between IT investment and financial return. Likewise, it negatively moderates the IT-risk link because internal learning tend to reduce uncertainty brought by IT. Related diversification benefits more than unrelated diversification due to less coordination required by unrelated diversification. By the same token, the paper propose that vertical integration will decrease the influence IT investment has on financial risk. However, whether an IT investment is externally oriented should be taken into account when considering the moderating effect of vertical integration on the link between IT investment and financial return. Finally the paper also compares the moderating impact based on other firm characteristics such as service versus manufacturing, high IT-intensity versus low IT-intensity, recent time periods versus older time periods. All of the hypotheses are verified by empirical investigation. Robustness checks are also provided using different measurements of key independent variables and dependent variables.

Week3_Rai et al. (2015)_Vicky Xu

Fit and Misfit of Plural Sourcing Strategies and IT-enabled Process Integration Capabilities: Consequences of Firm Performance in the U.S. Electric Utility Industry

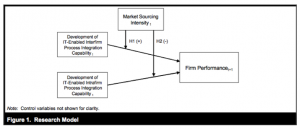

Rai et al. (2015) introduce the concept of market sourcing intensity (MSI), and propose that fit between MSI and the development of IT-enabled interfirm process integration capability improves firm profitability, assessed by return on assets, and misfit between MSI and the development of IT-enabled intrafirm process integration capability extracts penalties in firm profitability.

Rai et al. (2015) address the research question as: How does the (mis) fit between a firm’s plural sourcing strategies and the development of IT-enabled interfirm and intrafirm process integration capabilities influence firm performance? Then Rai et al. (2015) present a theoretical framework as the following (Figure 1., p868):

Where:

- H1: The marginal returns to firm performance from developing IT-enabled interfirm process integration capability increase with an increase in market sourcing intensity.

- H2: The marginal returns to firm performance from developing IT-enabled intrafirm process integration capability decrease with an increase in market sourcing intensity.

Rai et al. (2015) collected a panel dataset using multiple archival sources of firm-year (from 1994 to 2004) that included 6,685 observations for 342 major power-generation utility firms in the United States. After using the OLS estimation method, all the hypothesized relationships were validated.

The significant contributions of this paper include: (1). Elaborating the theoretical explanations on business value created by IT from a capabilities perspective, with a focus on how IT resources and capabilities, to an integrated capabilities-governance perspective, with a focus on the discriminating alignment between capabilities and governance of transactions. (2). Providing suggestions for IT executives and sourcing managers that they can collaborate to create synergies between investments in IT-enabled process integration capabilities and plural sourcing choices.

Week3_Dewan and Ren (2011)_Yaeeun Kim

IT investment as a return or risk. How does a firm increase return and decrease risk by using boundary strategies: vertical integration and diversification.

From the findings, this paper suggests that suitable boundary strategies can moderate the impact of information technology (IT) on firm performance, increasing return and decreasing risk. This tendency is apparent especially when the firm is categorized as service industry, with high levels of IT investment intensity, and in more recent time periods.

Diversification refers to the extent to which the firm chooses to operate in multiple lines of business or product markets, whereas vertical integration is the extent to which value chain activities are conducted inside the firm as opposed to contractually with business partners.

Vertical integration (VIit) is measured with two ways: The first measure is the ratio of value added to sales (Adelman, 1955). Second, an alternate measure was used for robustness, which is less sensitive to industry differences (Fan and Lang, 2000; Ray et al., 2006).

Key dependent variables are firm return and firm risk, and the set of predictor variables includes IT capital, degrees of diversification and vertical integration, along with other firm and industry control variables.

Among key independent variables, a level of diversification (DIVit) was analyzed with the entropy measure (Palepu, 1985).

From the analysis, diversification is negatively associated with both returns and risk at 1% significance level, and vertical integration is positively associated with return but negatively associated with risk model. For the individual interaction term of IT with diversification or IT with vertical integration is positive in return model and negative in risk model, confirming the significant moderating impact of firm boundaries on firm risk-return performance.

Week 3_Rawley and Simcoe (2013)_Jung Kwan Kim

Rawley and Simcoe (2013) examines how technology adoption influences firm boundaries and worker skills. Prior studies have connected the issue of the firm boundaries with asset specificity and contractual incompleteness. More specifically, transaction cost economics (TCE; Williamson, 1975; 1985) suggests that vertical integration helps firms reduce the inevitable cost of conflicts over the division of surplus in a locked-in trading relationship; property right theory (PRT; Grossman and Hart, 1986; Hart and Moore, 1990) emphasizes the incentive of ownership to make efficient but noncontractable investment. In short, TCE and PRT argue that firms are more likely to perform vertical integration with a high asset specificity and a high level of contract incompleteness. Interestingly, Rawley and Simcoe (2013) support the causal relationship between the adoption of a new technology and the increase in vertical integration by holding asset capacity constant.

Based on the in-depth look in the empirical setting of the taxicab industry, the authors find that a technological adoption leads to an increased level of vertical integration and deskilling within the firm, even in the absence of noncontractible changes in asset specificity. On the condition that the marginal benefits of information technology adoption are diminishing with worker ability, this main finding can be intuitively understood in that the technology adoption cannot replace the input capital while the mix of skills and relative productivity of employees can be easily altered.

Week3_Ray et al(2009)_Xue Guo

Competitive Environment and the Relationship Between IT and Vertical Integration

In this paper, authors mainly discussed two questions: 1. How does the competitive environment moderate the relationship between IT and VI (vertical integration)? 2. How does the level of VI in different competitive environments influence firms’ performance (coordination and production cost)? Basically, this paper examines the relationship of four constructs: IT, VI, competitive environment and firm performance.

Previous literature showed that IT is associated with a decrease in VI. However, this paper examines that different competitive environments have various impacts on the relationship between IT and VI. Moreover, the authors found that the level of VI may affect the firms’ performance based on diverse competitive environment.

The paper empirically examines the model using firm-level IT spending data from 1995 to 1997. Two measures of the competitive environment are demand uncertainty and industry concentration that complement each other and the measures of firm performance are coordination cost and production cost. The paper uses 2-equation model, which run both directions (from IT to VI and VI to IT) to examine the first question, which can address the endogeneity problem between IT and VI.

The results suggest that in uncertain demand and in unstable competitive environment, IT is associated with decreased VI. And in more predictable and concentrated environment, IT is associated with increased VI. Also, the paper found that firms made rational strategies about VI and IT in different competitive environments to decrease the coordination and production cost. Compared with the previous literature, this paper provides a more refined understanding of the relationship between IT and VI.

Week3_Ada

Contractibility and Asset Ownership: On-Board Computers and Governance in U.S. Trucking

Key concepts:

On-board computers (OBCs) appeared on the market during the mid-to-late 1980s.There are two classes of OBCs: trip recorders and electronic vehicle management systems (EVMS). Both classes of OBCs provide carriers better measures of how drivers operate trucks.

Incentives for driver ownership of trucks: scope for good driving and scope for rent-seeking[1]

Incentives for carrier ownership of trucks: bargaining power

Research questions:

This paper examines relationships between trucks ownership and the contracting environment, when an important new technology became available that fundamentally changed contractibility in the industry.

Main findings:

Driver ownership of trucks has declined with increases in the contractibility of drivers’ actions. Specifically, 1) driver ownership of trucks decreases with OBC adoption; 2) driver ownership decreases with OBC adoption more for longer than shorter hauls; 3) driver ownership decreases with OBC adoption less for hauls that use trailers for which demands tend to be unidirectional than bidirectional.

Contributions:

Exploration of relationships between OBC adoption and ownership changes constitutes the main empirical contribution of the paper. The analysis in this paper may explain relationships between contractibility and firms’ boundaries in other contexts, especially those in which the care of valuable assets is important. The results in this paper suggest that changes in monitoring technology could change the industry structure in this sector. Such changes could similarly affect the professions.

[1] Rent-seeking is an attempt to obtain economic rent (i.e., the portion of income paid to a factor of production in excess of what is needed to keep it employed in its current use) by manipulating the social or political environment in which economic activities occur, rather than by creating new wealth. Rent-seeking implies extraction of uncompensated value from others without making any contribution to productivity. The classic example of rent-seeking, according to Robert Shiller, is that of a feudal lord who installs a chain across a river that flows through his land and then hires a collector to charge passing boats a fee (or rent of the section of the river for a few minutes) to lower the chain. There is nothing productive about the chain or the collector. The lord has made no improvements to the river and is helping nobody in any way, directly or indirectly, except himself. All he is doing is finding a way to make money from something that used to be free.